An ETRM Solution for Utilities

Feature and function highlights for

Utilities

Feature and function highlights for

Utilities

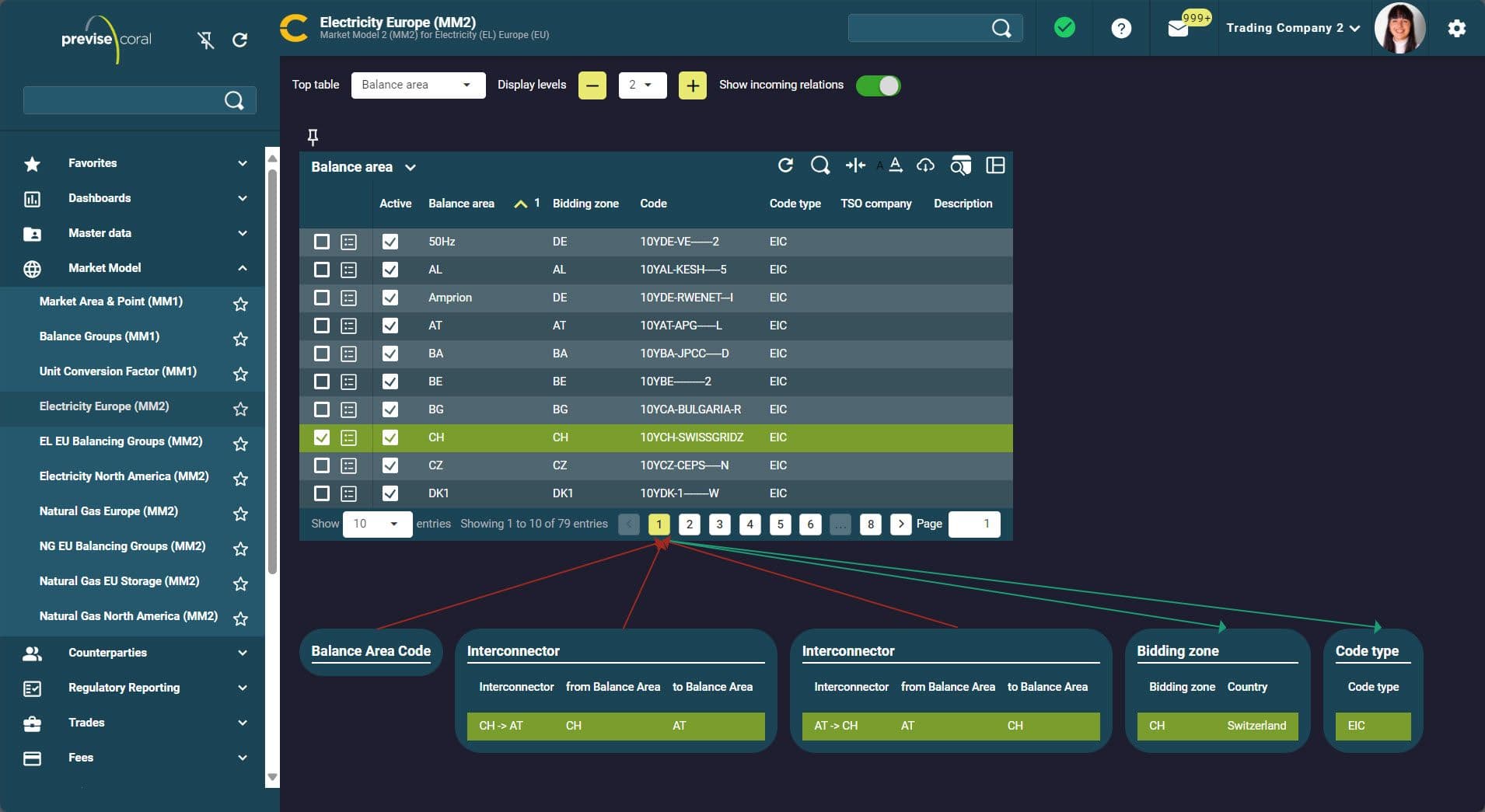

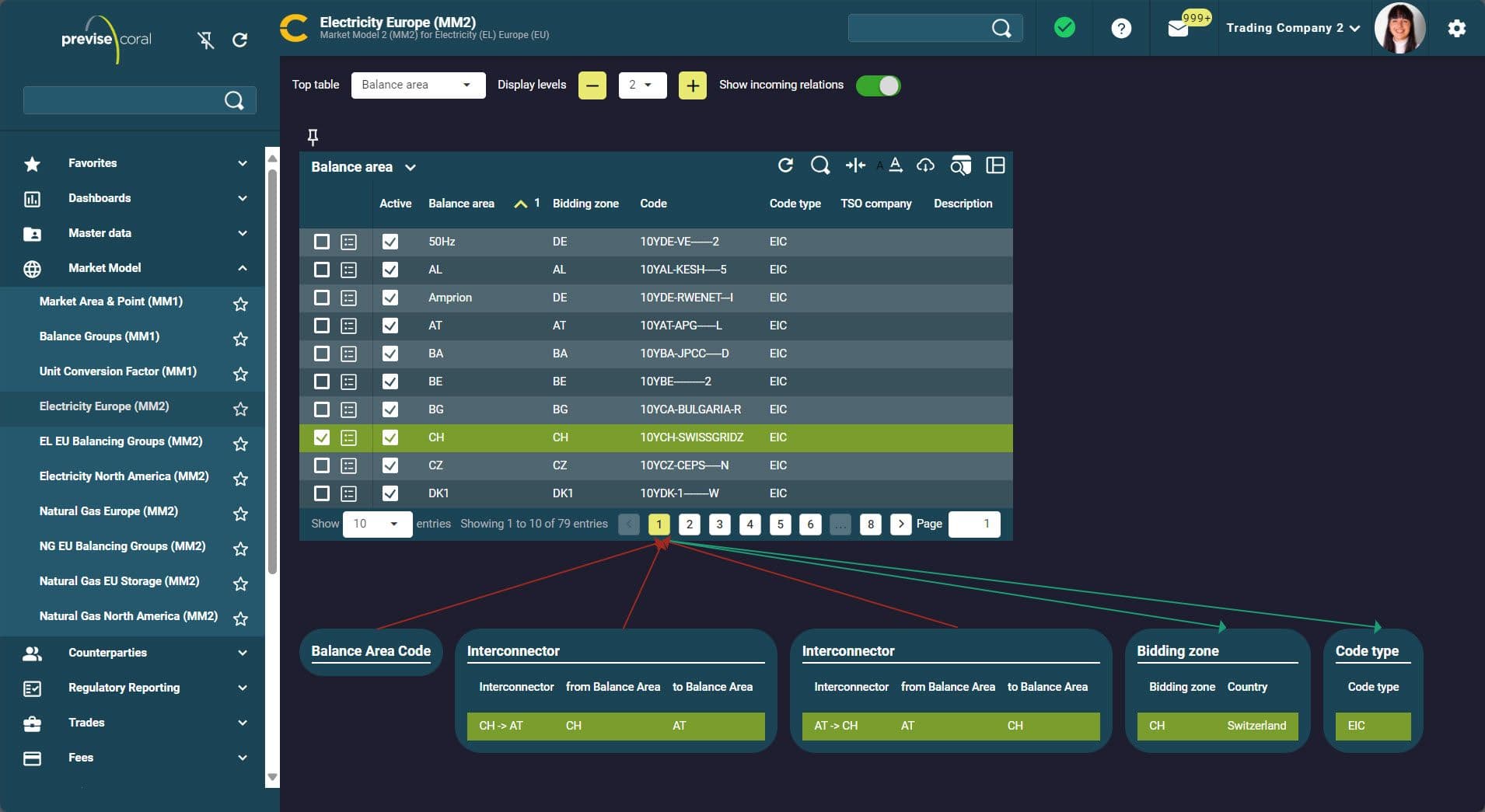

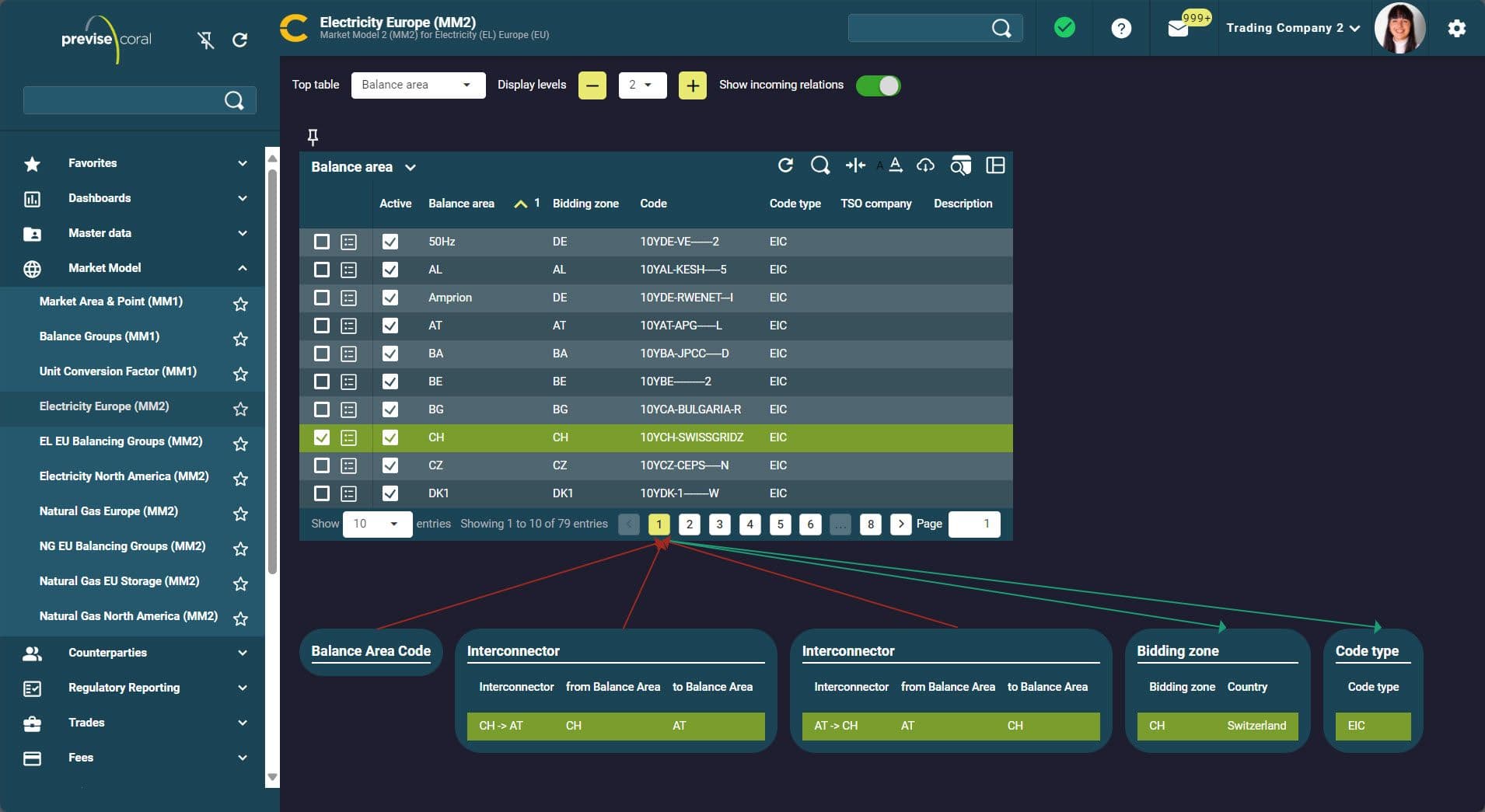

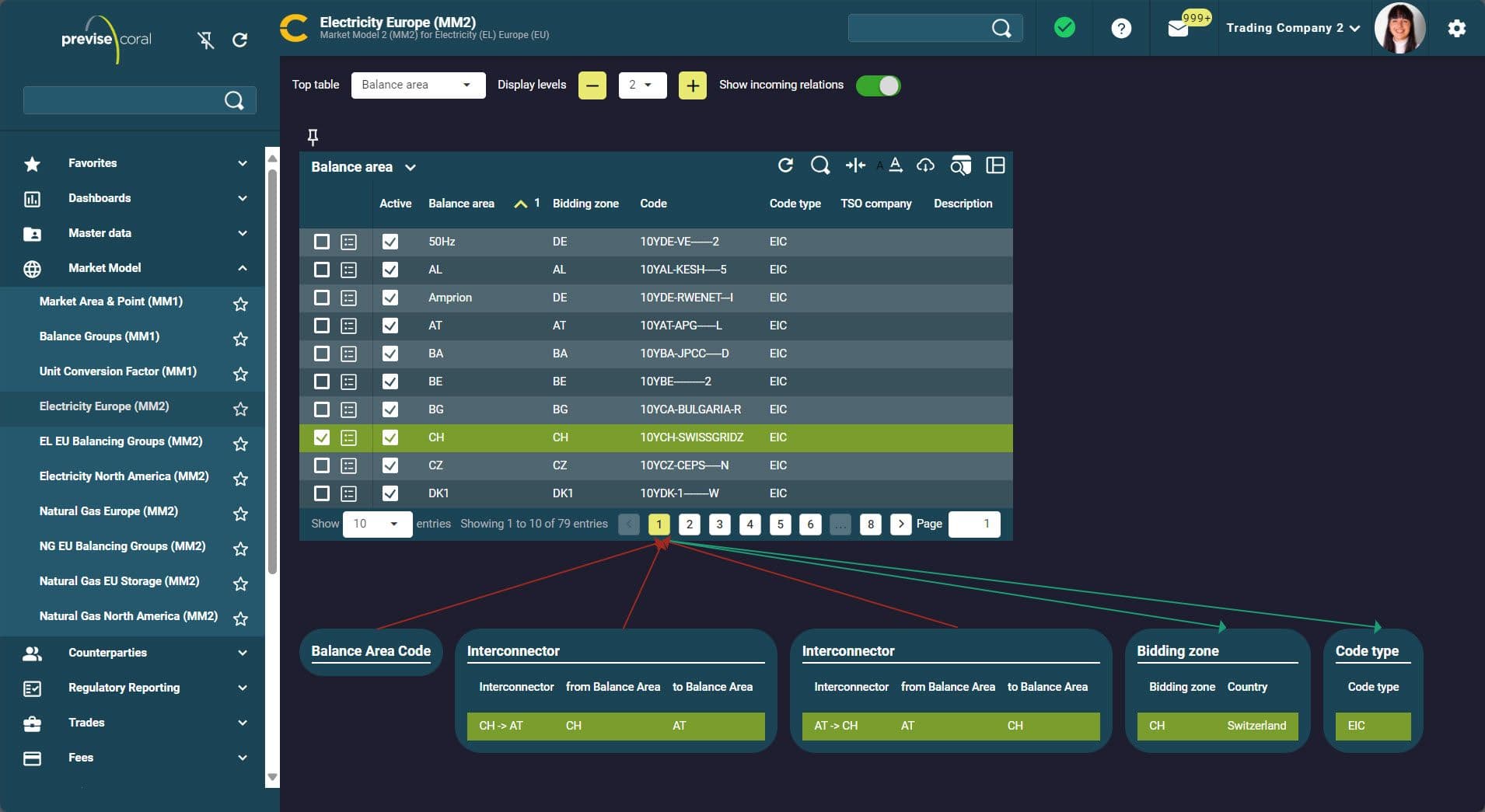

As the energy sector continues to evolve, Utilities are facing increasing complexity in market volatility, real-time processing and management of large data volumes, regulatory compliance and exposure management. Traditional ETRM solutions often struggle to keep up with the dynamic demands of the market.

Previse Coral is a cloud-native, feature-rich solution designed to streamline trading, optimise position and exposure calculations and ensure seamless operations and integrations across the entire energy value chain.

From handling large volumes of demand, generation and consumption data, to deal lifecycle management, reporting and settlement, our platform provides the ability to foster a best-of-breed IT landscape to manage power, gas and certificate trading efficiently.

Previse Coral for Utilities

Demand, Generation and Consumption Data Management

Previse Coral for Utilities

Demand, Generation and Consumption Data Management

Deal Lifecycle Management

From trade capture to settlement, Previse Coral supports the full lifecycle of your cross-commodity energy portfolio - designed with utility market structures and workflows in mind:

Previse Coral for Utilities

Deal Lifecycle Management

Previse Coral for Utilities

Deal Lifecycle Management

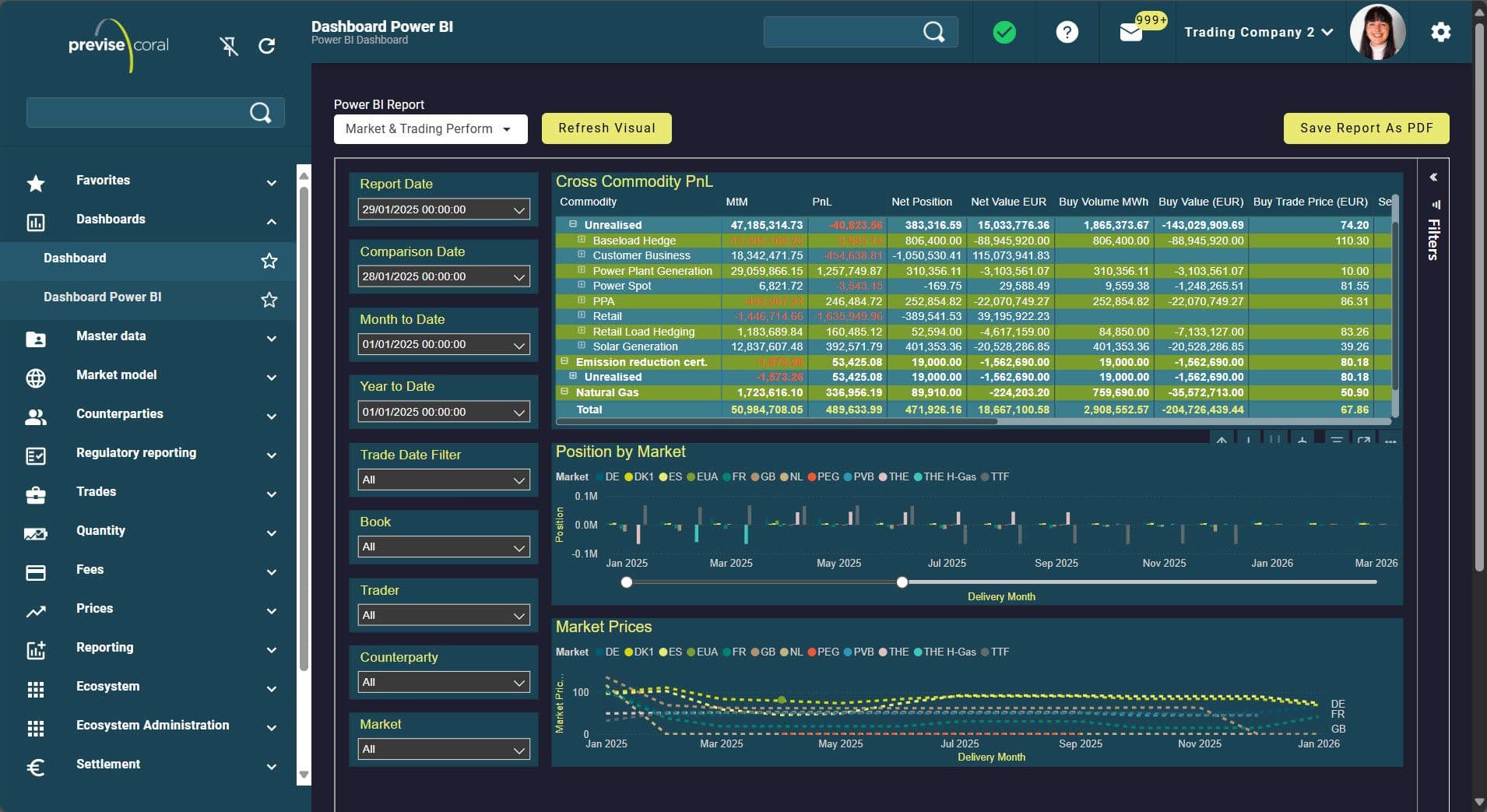

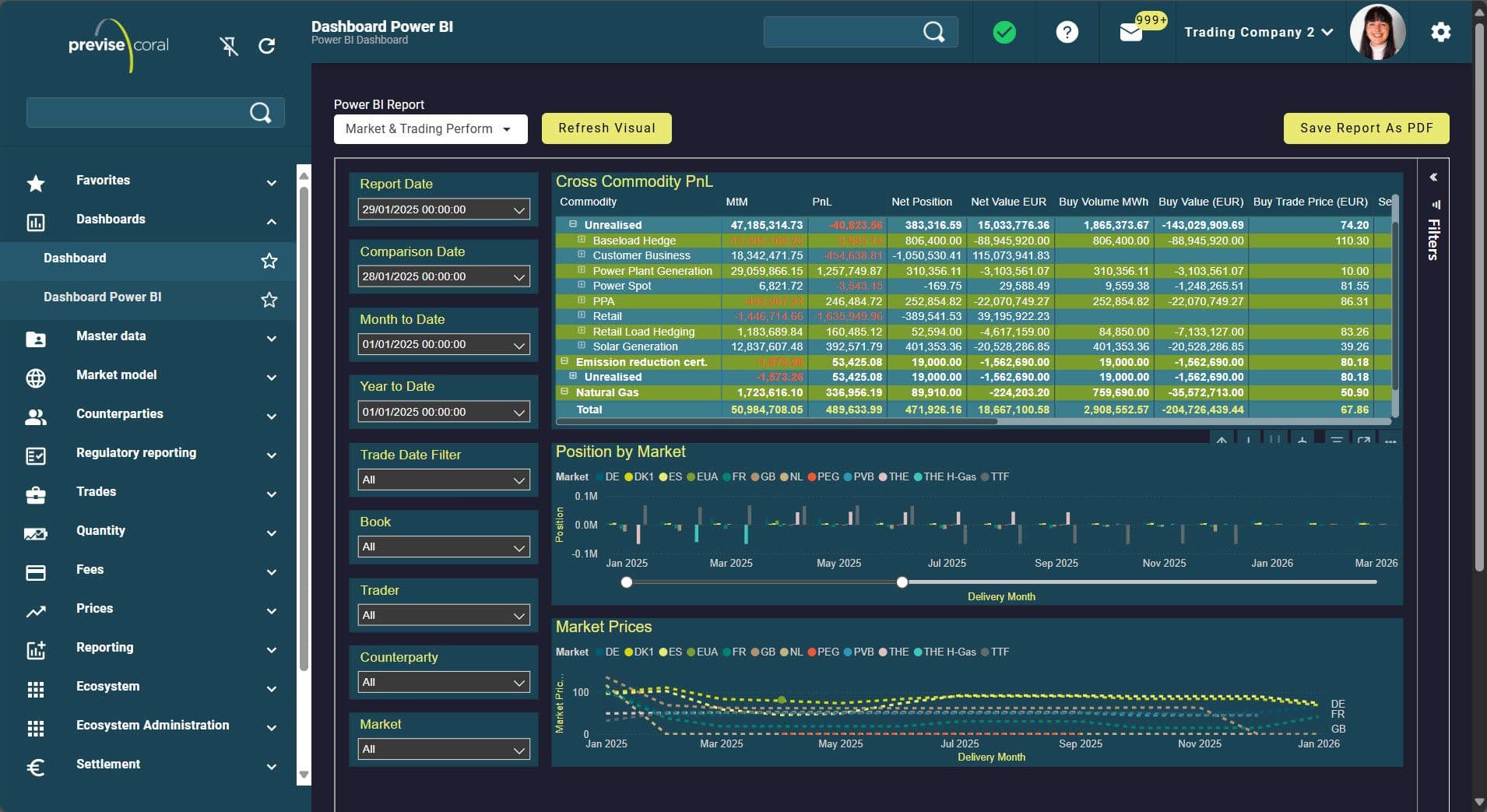

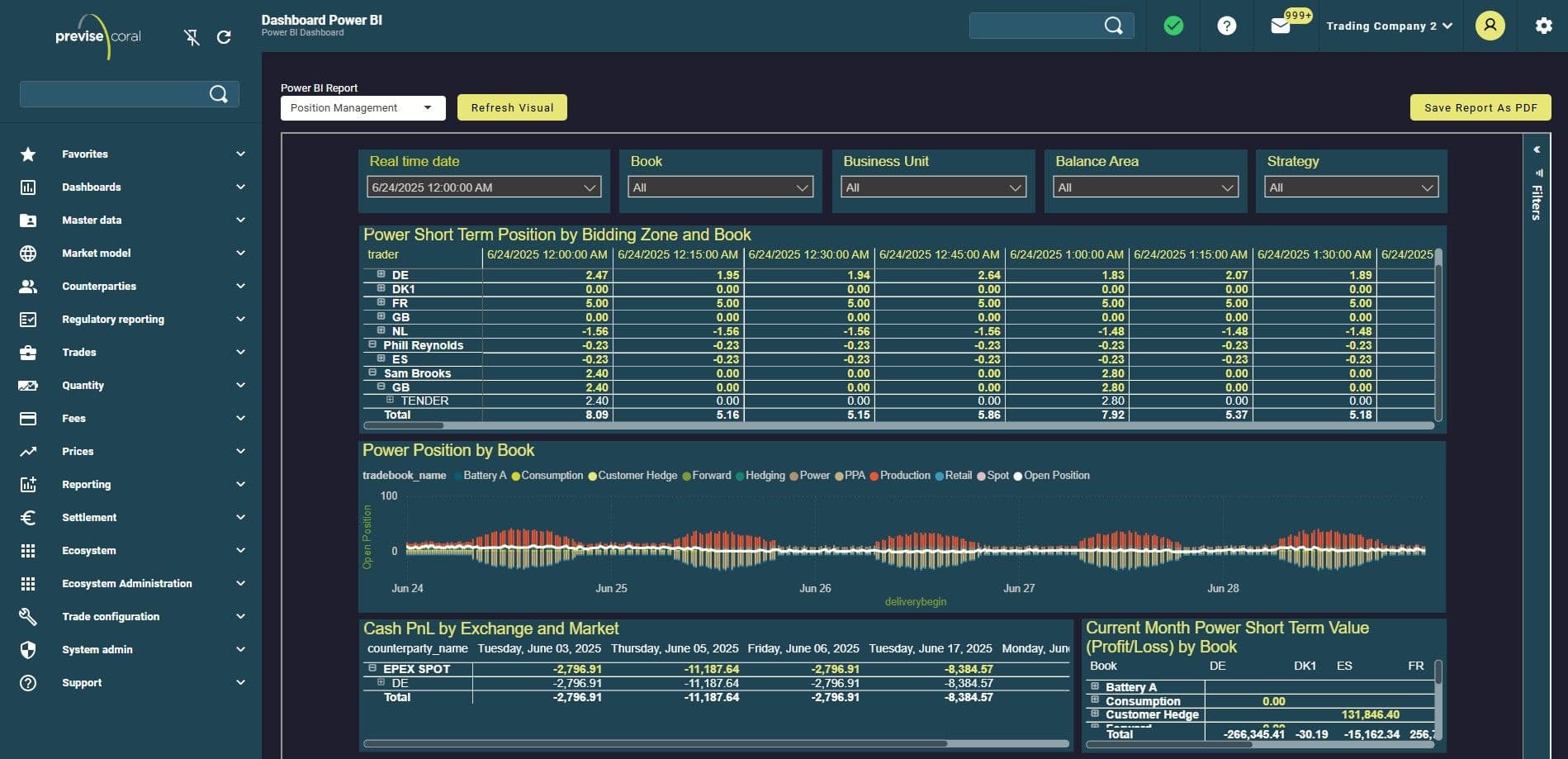

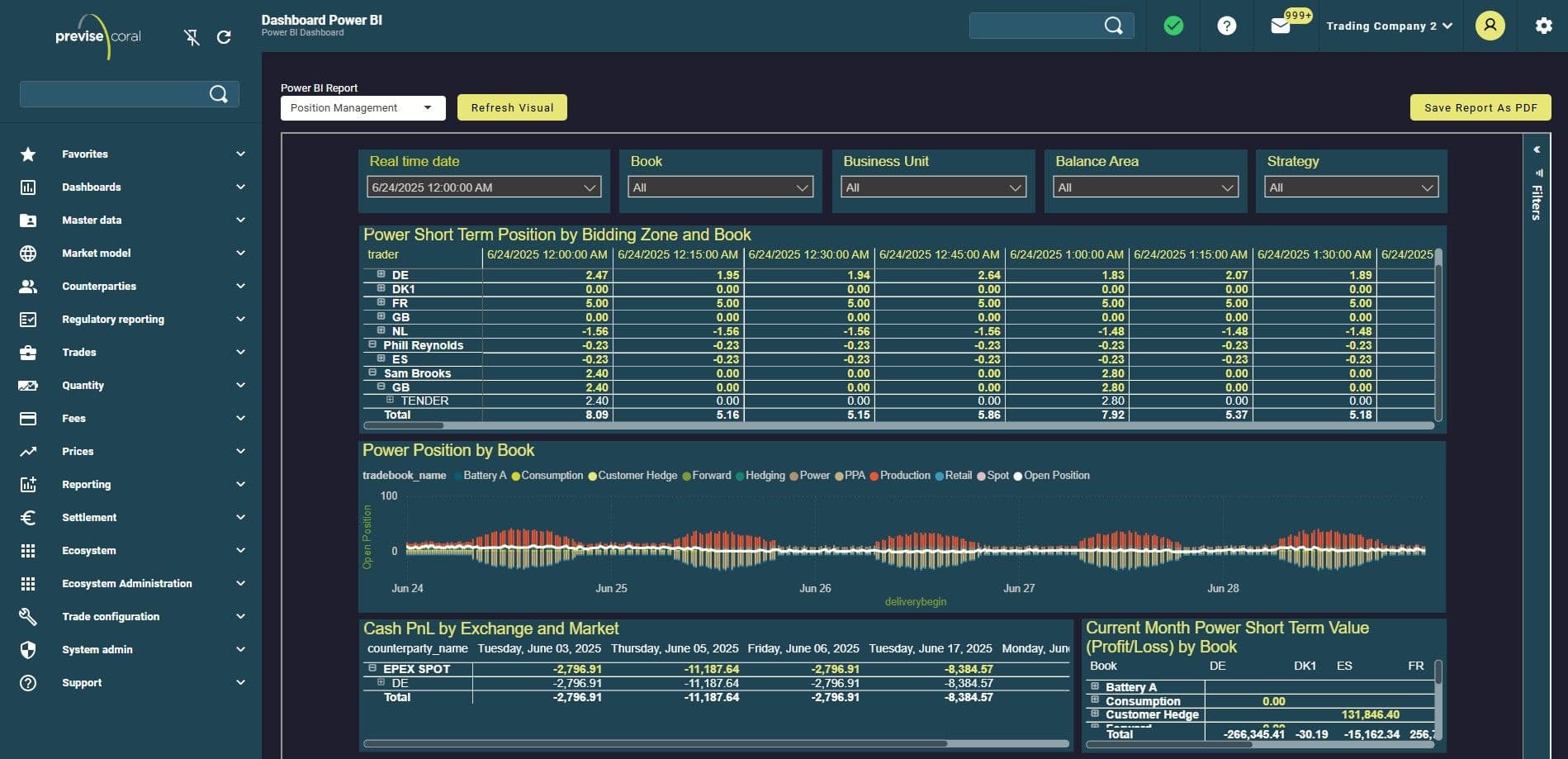

Position and Exposure

Utilities need complete visibility across physical and financial portfolios to manage risk, stay balanced, and meet regulatory obligations. Previse Coral delivers a flexible, real-time environment to support this - combining automated data ingestion, high-performance valuation, and powerful reporting tools.

Previse Coral for Utilities

Position and Exposure Management

Previse Coral for Utilities

Position and Exposure Management

Previse Coral for Utilities

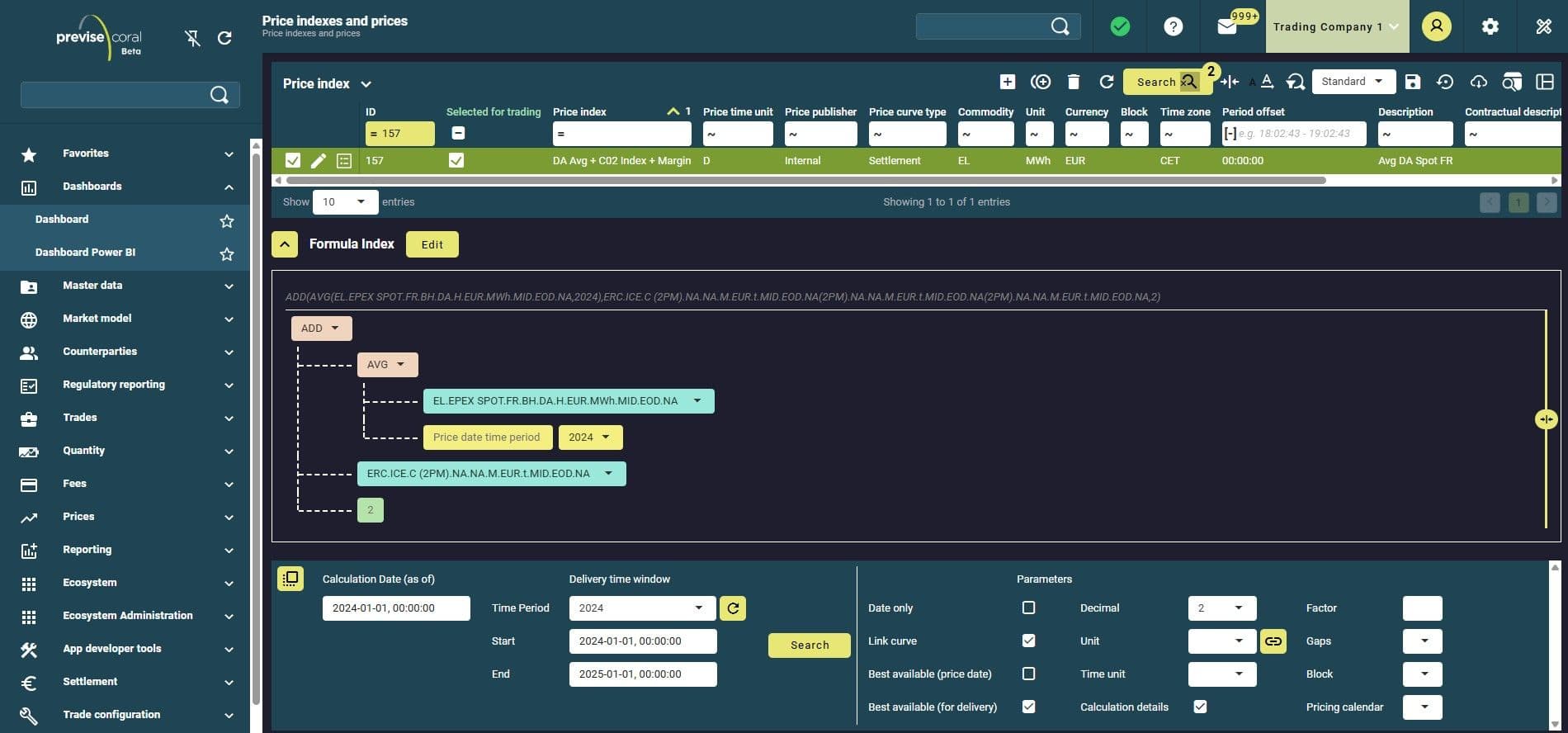

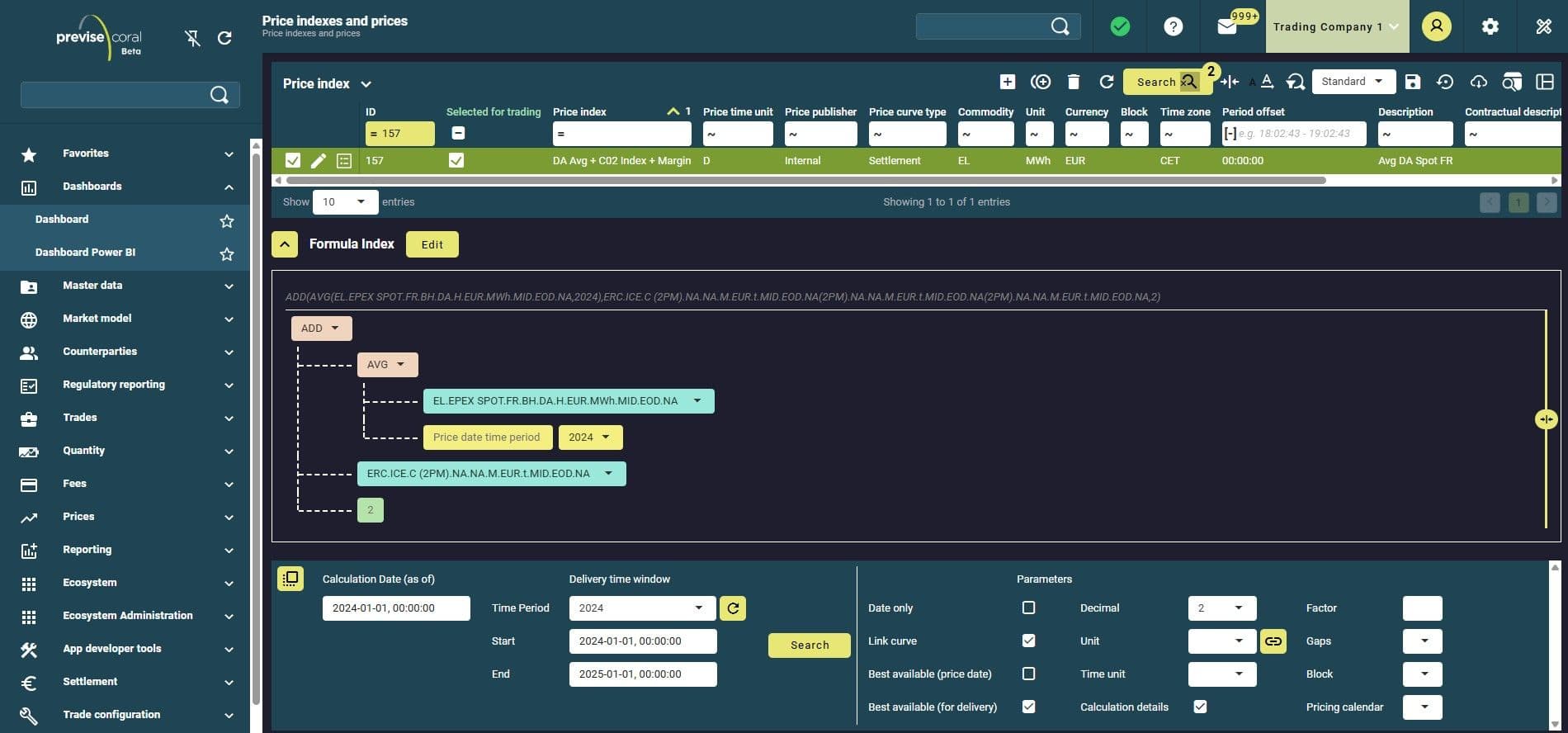

Price and Forward Curve Management

Reliable and accurate pricing is critical for trading and risk management. Previse Coral enables:

Previse Coral for Utilities

Price and Forward Curve Management

Reliable and accurate pricing is critical for trading and risk management. Previse Coral enables:

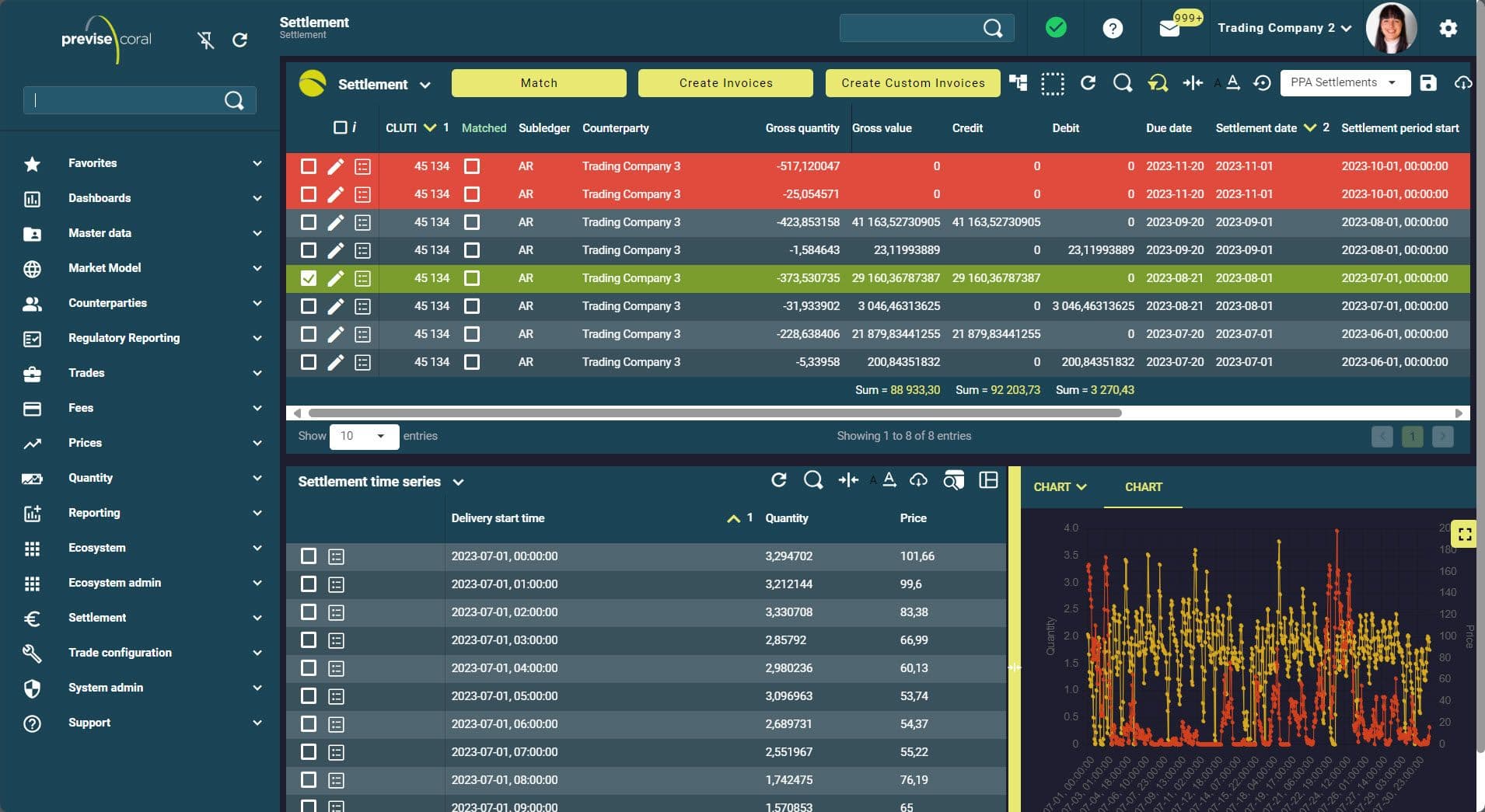

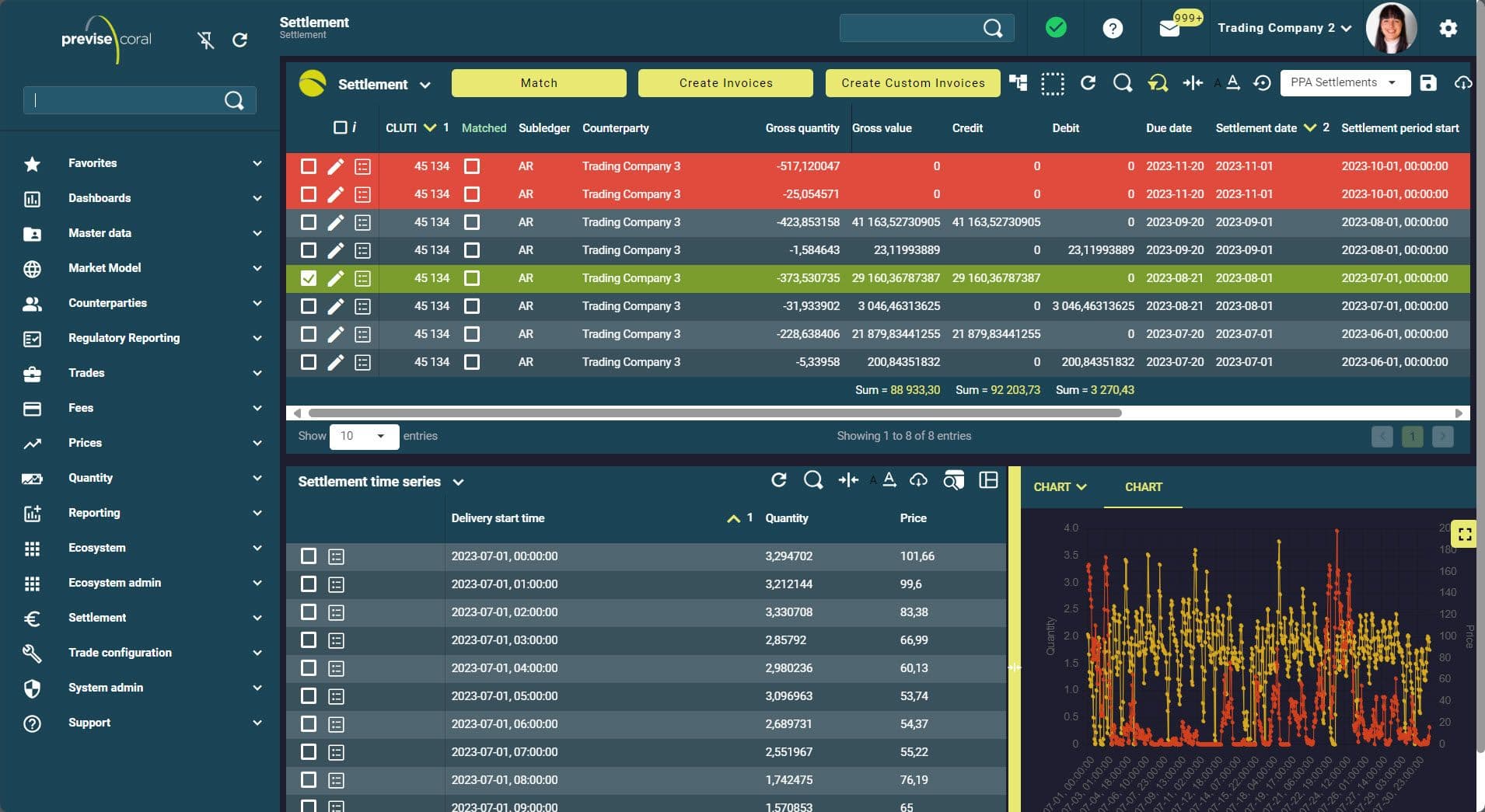

Settlement and Invoicing

For utility companies managing high transaction volumes across OTC markets, TSOs and exchanges, precise and timely reconciliation is essential. Previse Coral’s settlement component is designed to mirror the actual settlement cycles and timing conventions of each transaction type, ensuring that generated settlement data aligns with how trades are truly settled in practice. Its configurable rule engine and integration capabilities provide a solid foundation for automating reconciliation processes with a high degree of accuracy and auditability.

Previse Coral for Utilities

Settlement and Invoicing

Previse Coral for Utilities

Settlement and Invoicing

Why Previse Coral?

Utility companies operate at the intersection of regulated market participation, complex grid interactions, and high-volume transactional processes. Many still rely on fragmented legacy systems that struggle to adapt to evolving market models, increasing data granularity, and tighter settlement cycles. Previse Coral offers a future-ready alternative.

Cloud-Native and Scalable

Built on Microsoft Azure using serverless technologies, Coral scales automatically to handle peaks in trading, scheduling, or reporting volumes. There's no infrastructure to manage - just a high-performance platform that evolves with your business.

Operational Transparency and Automation

From imbalance reconciliations to real-time position tracking and regulatory-ready data, Coral helps utility teams move away from manual workarounds and focus on decision-making. Dashboards, configurable alerts, and embedded PowerBI reporting provide clear oversight at every level.

Flexible Integration by Design

Coral is API-first, making it easy to integrate with grid operators, data providers, ERP systems, and analytics platforms. Utility companies can replace legacy point-to-point solutions with a coherent, event-driven architecture.

Extendable Without Lock-In

With the EcoSystem App Framework, utilities can build or adopt custom apps that extend Coral's core capabilities - without waiting for a vendor roadmap. This keeps IT agile and responsive to market rule changes or internal process evolution. Modernise your energy trading operations with Previse Systems' cloud-native ETRM platform - built on a modern, scalable architecture and designed for seamless integration.