An ETRM Solution for Energy Traders

Features and Function highlights for

Energy Traders

Previse Coral delivers a market-ready foundation with the flexibility to support everything from high-frequency intraday trading to structured PPAs and emissions portfolios.

Features and Function highlights for

Energy Traders

Previse Coral delivers a market-ready foundation with the flexibility to support everything from high-frequency intraday trading to structured PPAs and emissions portfolios.

Trading At Speed At Scale

In today’s hyper-volatile energy markets, trading houses are the engines of agility - snapping up opportunities, managing complex positions, and navigating shifting regulations faster than ever before. But to keep pace, you need more than a legacy ETRM with a facelift. You need a platform built for high-frequency, high-stakes trading.

Previse Coral is that platform. Cloud-native, lightning-fast, and brilliantly adaptable, Coral gives power, gas, and emissions traders the control they need - whether you're firing off 100,000 trades a day or managing intricate exchange positions across markets.

Coral for Traders

Performance That Keeps Up With You

In today's granular, fast-moving intraday power markets, every millisecond counts - and legacy systems can quickly become a bottleneck.

Coral for Traders

Performance That Keeps Up With You

In today's granular, fast-moving intraday power markets, every millisecond counts - and legacy systems can quickly become a bottleneck.

Coral for Traders

Always on Positioning Monitoring

In fast-moving power markets, flexibility and speed are critical. Coral gives traders and risk managers real-time access to live position data, continuously updated as trades, forecasts, and market prices evolve.

Coral for Traders

Always on Positioning Monitoring

In fast-moving power markets, flexibility and speed are critical. Coral gives traders and risk managers real-time access to live position data, continuously updated as trades, forecasts, and market prices evolve.

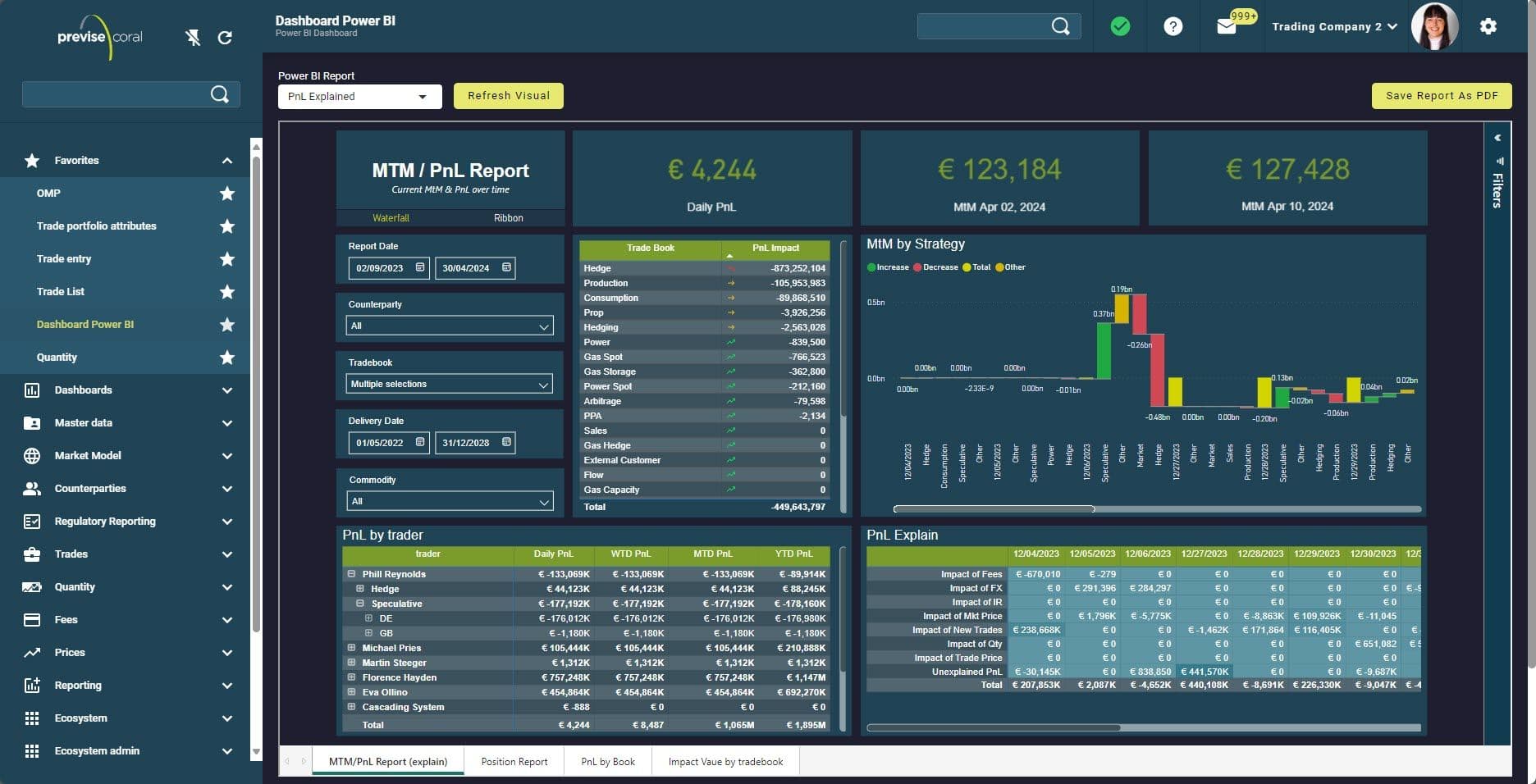

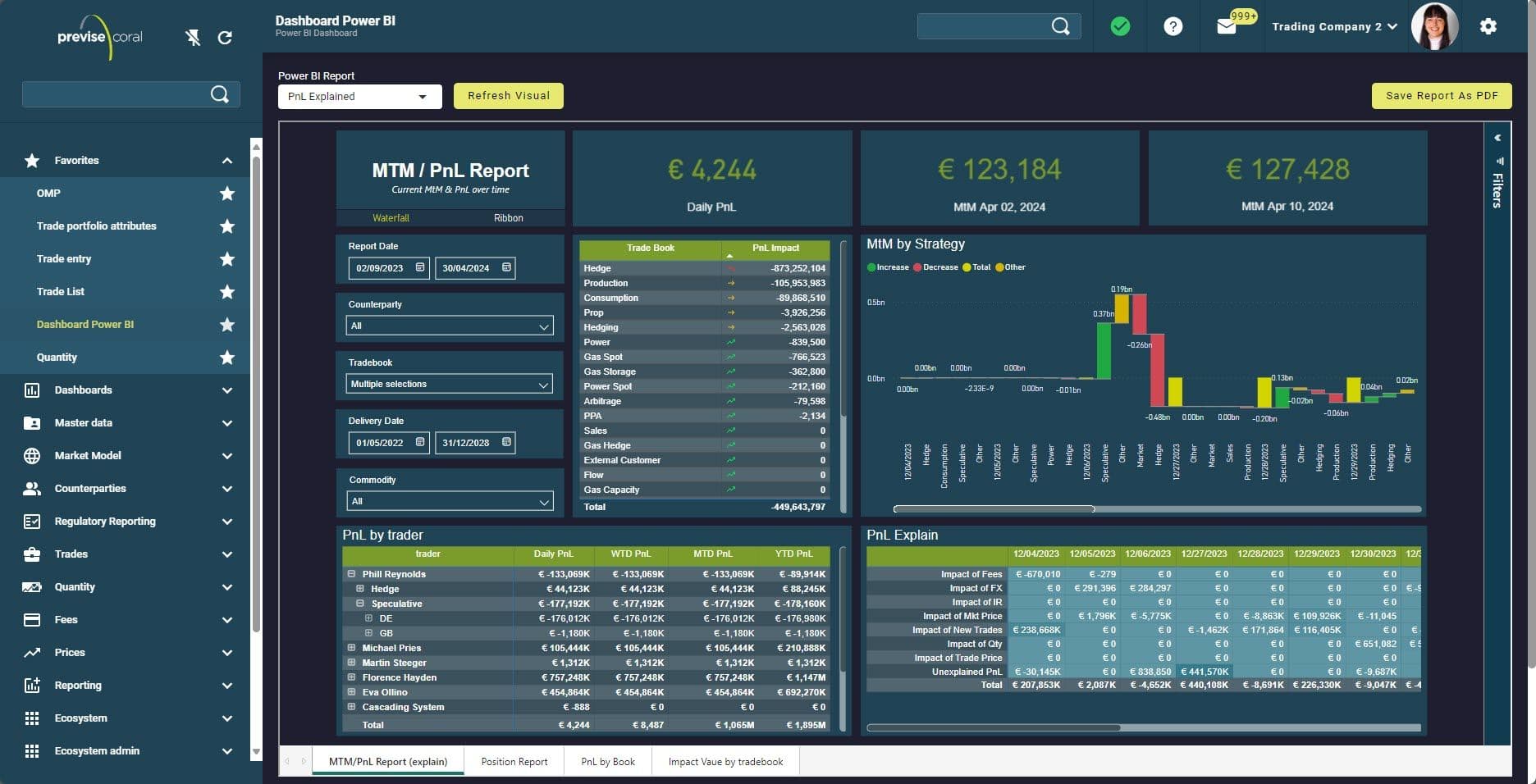

Previse Coral for Energy Traders

Valuation and Reporting

Coral’s valuation engine delivers fast, consistent updates at scale, while built-in PnL Explained logic helps contextualize the drivers behind position changes.

Use embedded PowerBI for ad hoc analysis, or pipe position data directly into your own models, dashboards, or downstream systems via open APIs. The architecture is designed to meet your needs - not impose limitations.

Previse Coral for Energy Traders

Valuation and Reporting

Coral’s valuation engine delivers fast, consistent updates at scale, while built-in PnL Explained logic helps contextualize the drivers behind position changes.

Use embedded PowerBI for ad hoc analysis, or pipe position data directly into your own models, dashboards, or downstream systems via open APIs. The architecture is designed to meet your needs - not impose limitations.

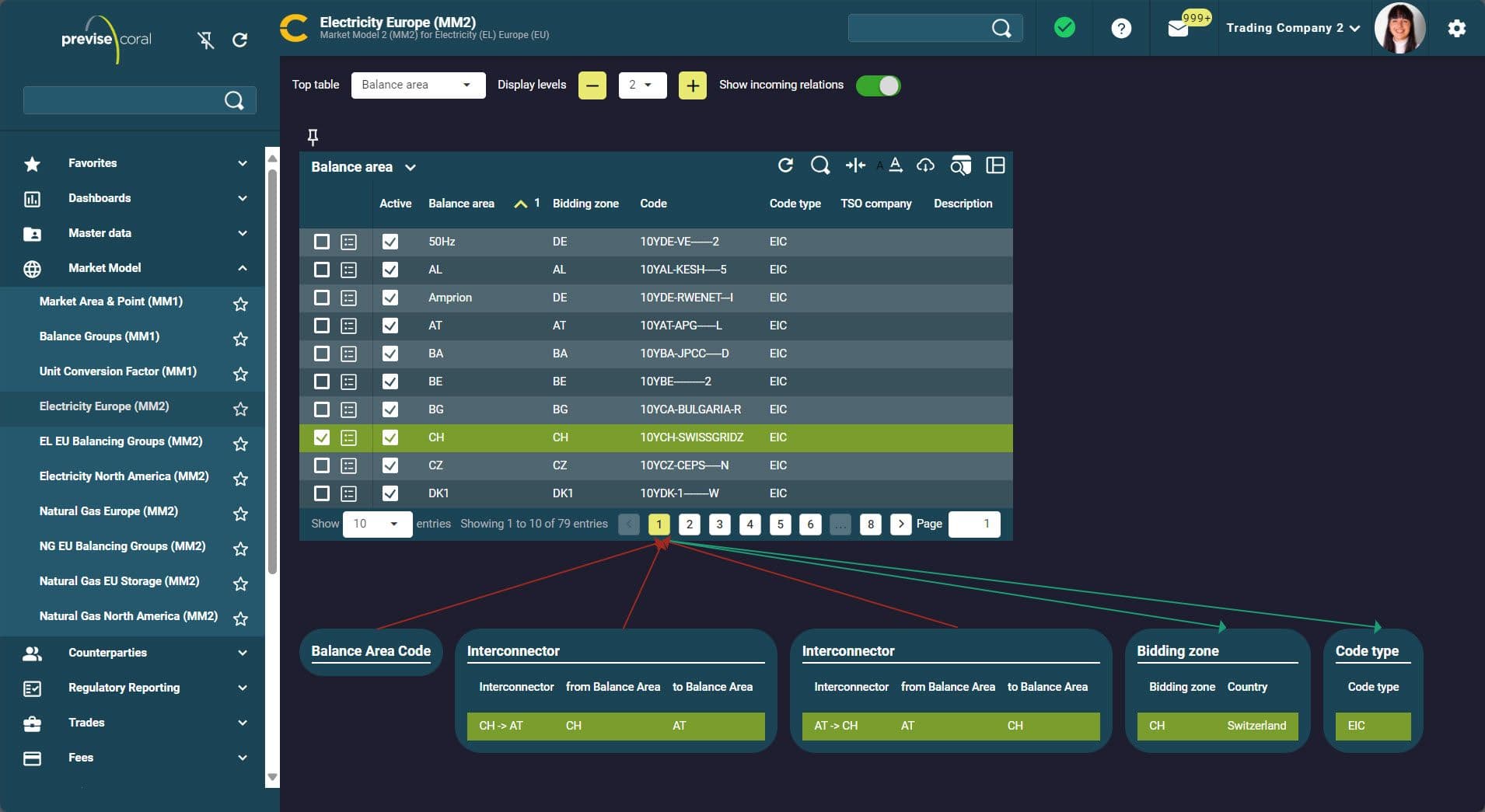

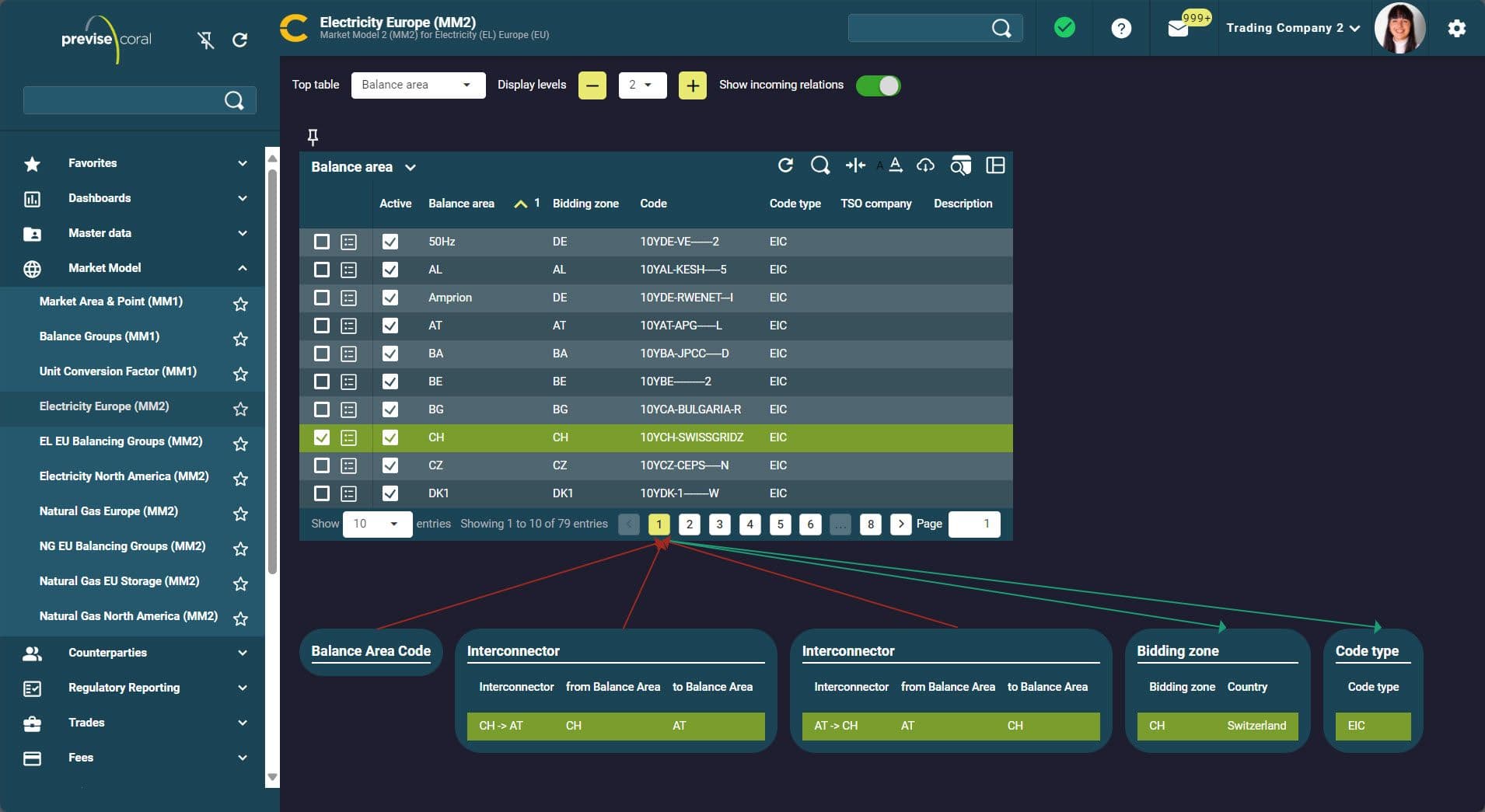

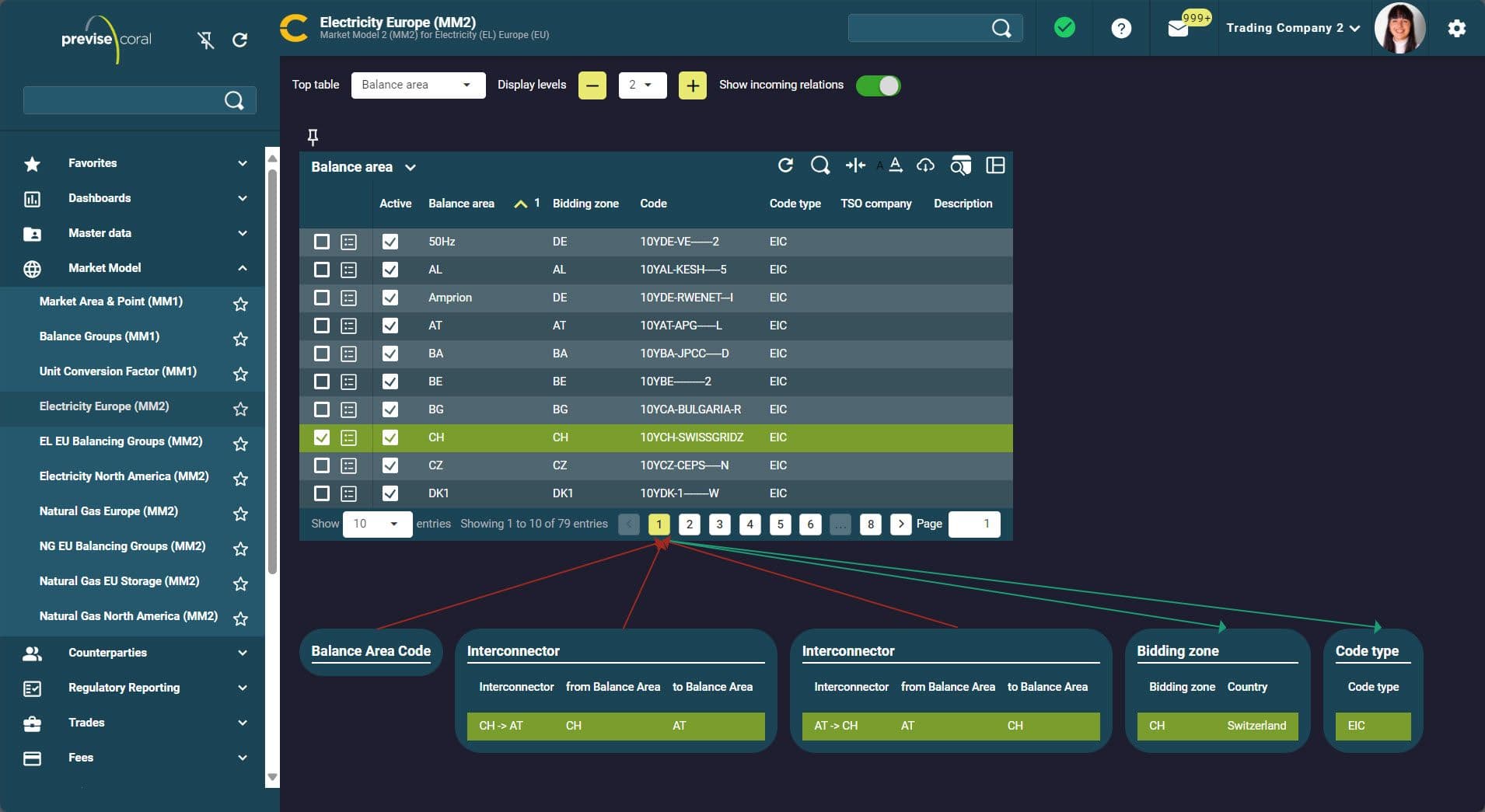

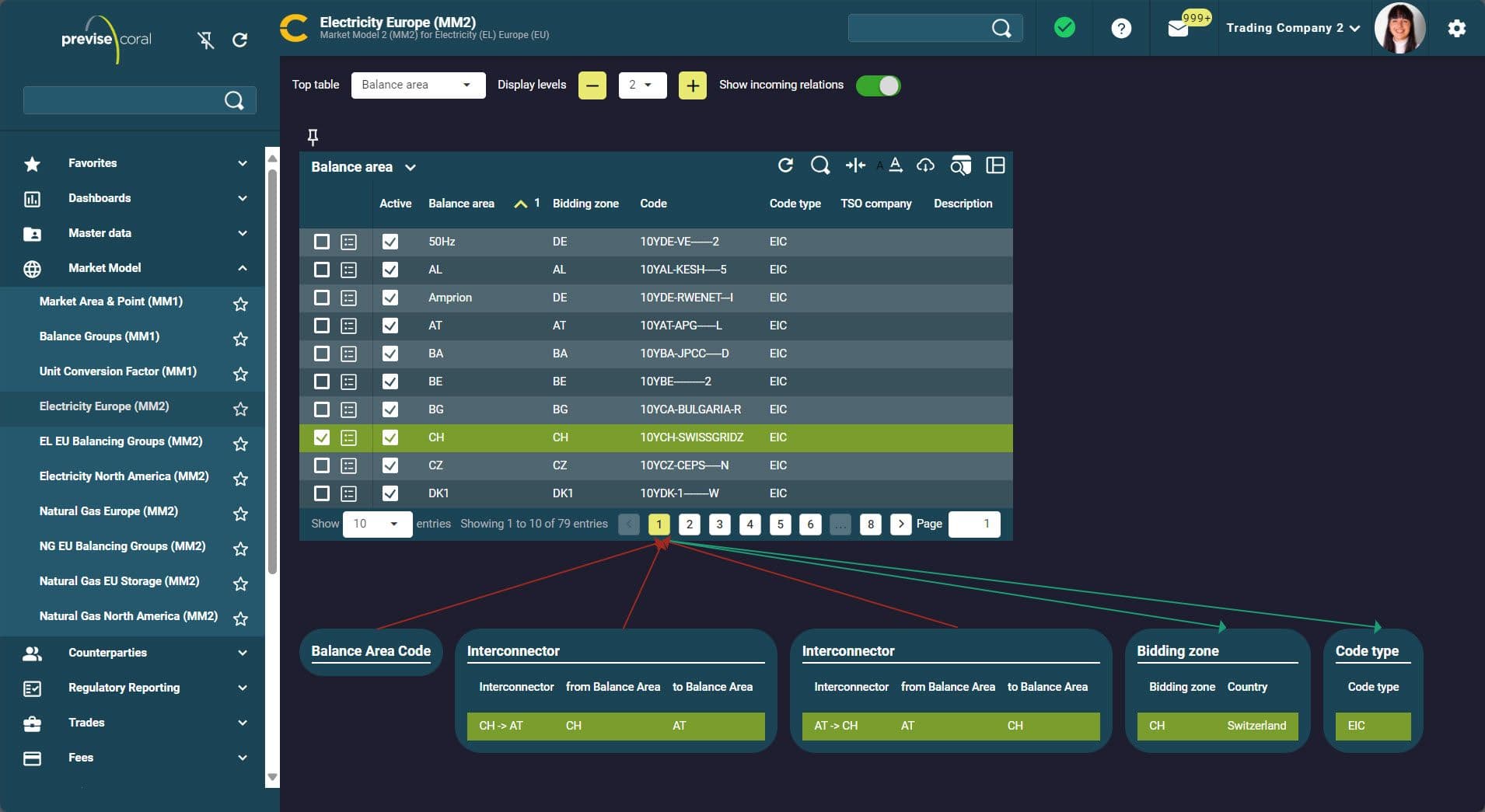

Fast Time to Market, by Design

Expanding your trading operation shouldn't mean months of configuration work. Coral is built to help you scale quickly - whether you're entering a new market, onboarding new products, or responding to evolving market conditions. From the outset, Coral comes equipped with a comprehensive set of exchange product definitions, trading calendars, market models and trade templates - so you can get started without the usual groundwork.

Our Master Data as a Service offering ensures that this foundational data stays current.

As markets evolve - introducing new contract types, shifting trading intervals, or updating calendar structures - Previse takes care of the updates, maintaining alignment without burdening your internal teams. You won't be held back by outdated reference data or rigid system dependencies.

Combined with Coral’s modular architecture and open API design, this approach gives you the flexibility to act on opportunity without delay - trading where and when it makes sense.

Why Trading Houses Choose Coral?

Energy traders need more than speed—they need a platform that scales, adapts, and connects.

Performance to Scale

Built to handle high-frequency, high-volume trading across intraday, spot, and derivatives markets - without compromising speed or reliability

Market-Ready Data

With Master Data as a Service, Coral comes preloaded with exchange products, calendars, counterparties, and much more - accelerating time to market and reducing operational overhead

Live Risk Visibility

Access real-time positions as trades, forecasts, and prices update - enabling informed decision-making in fast-moving markets

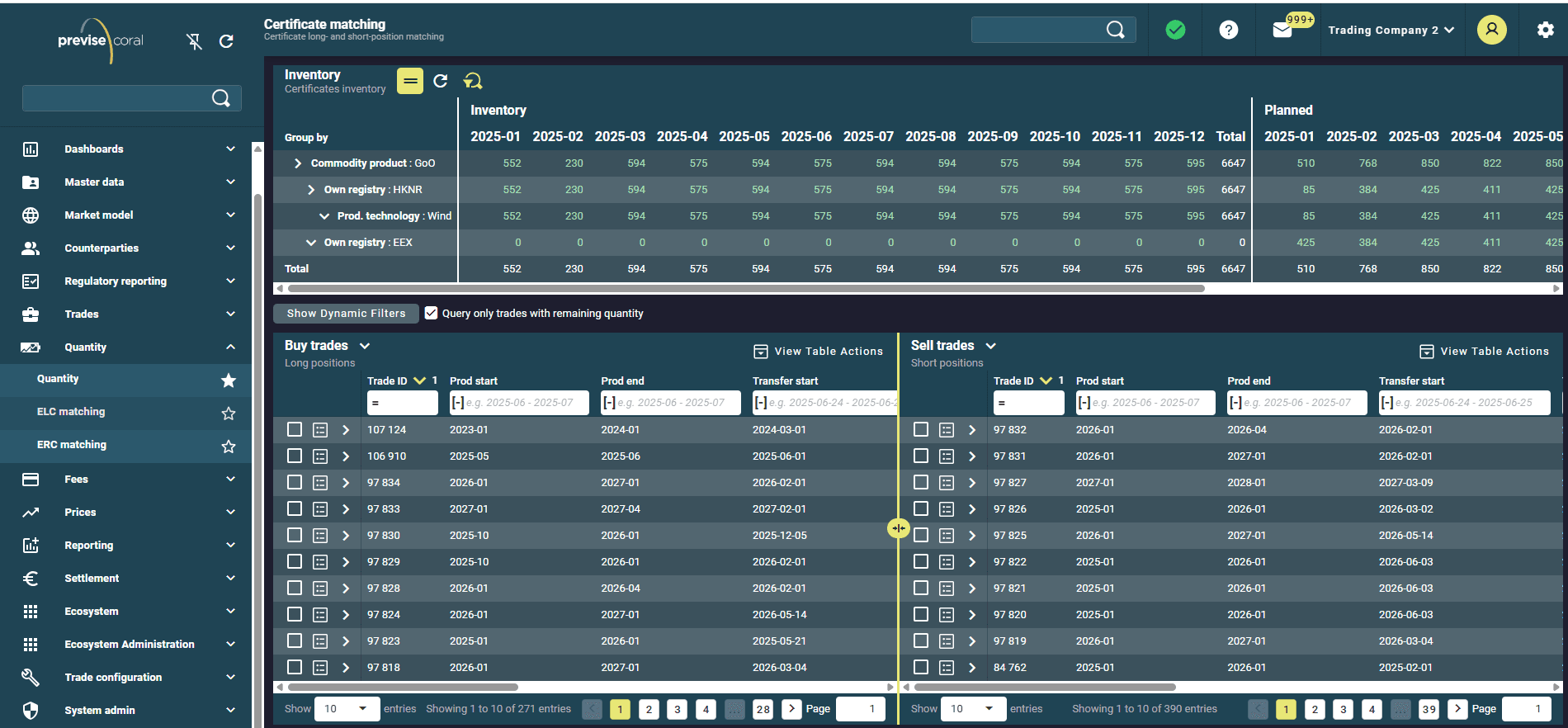

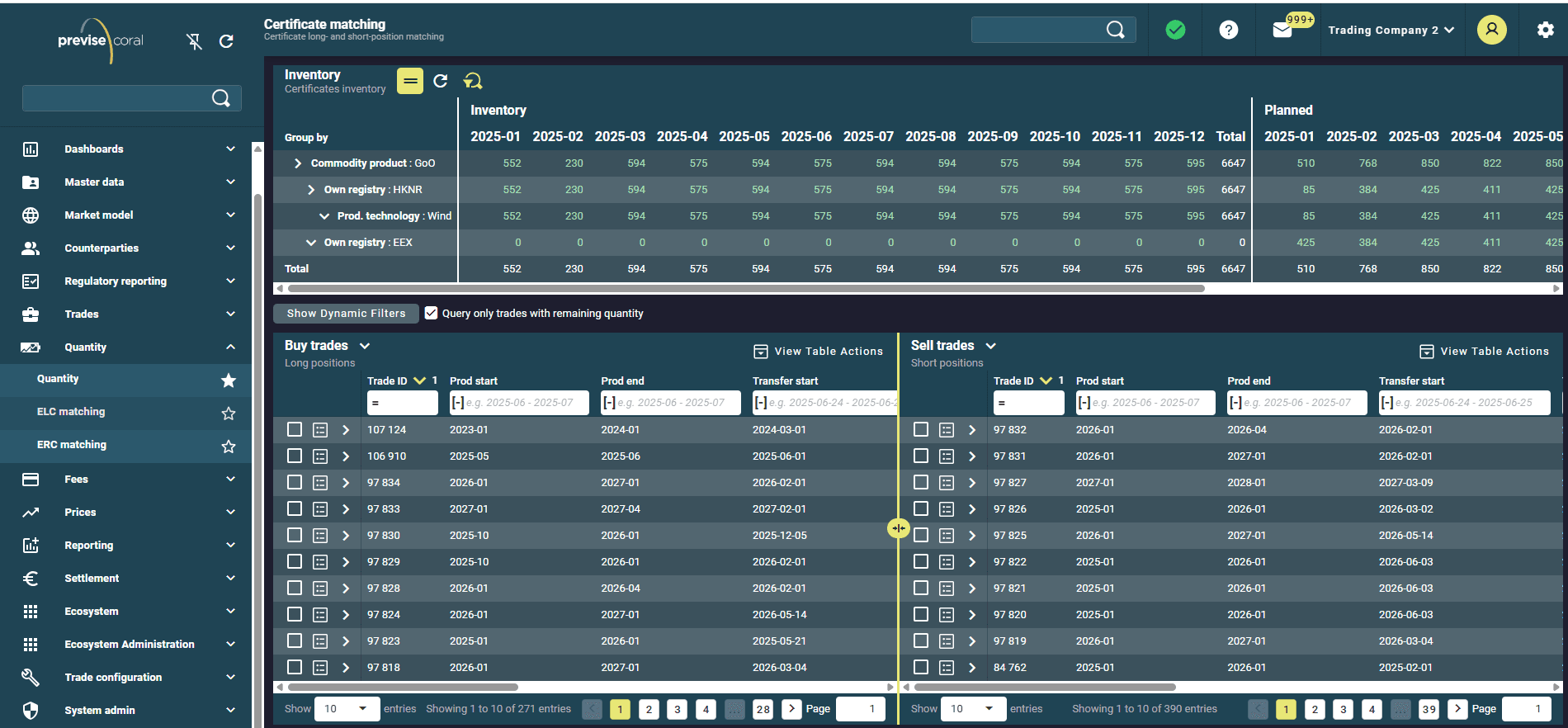

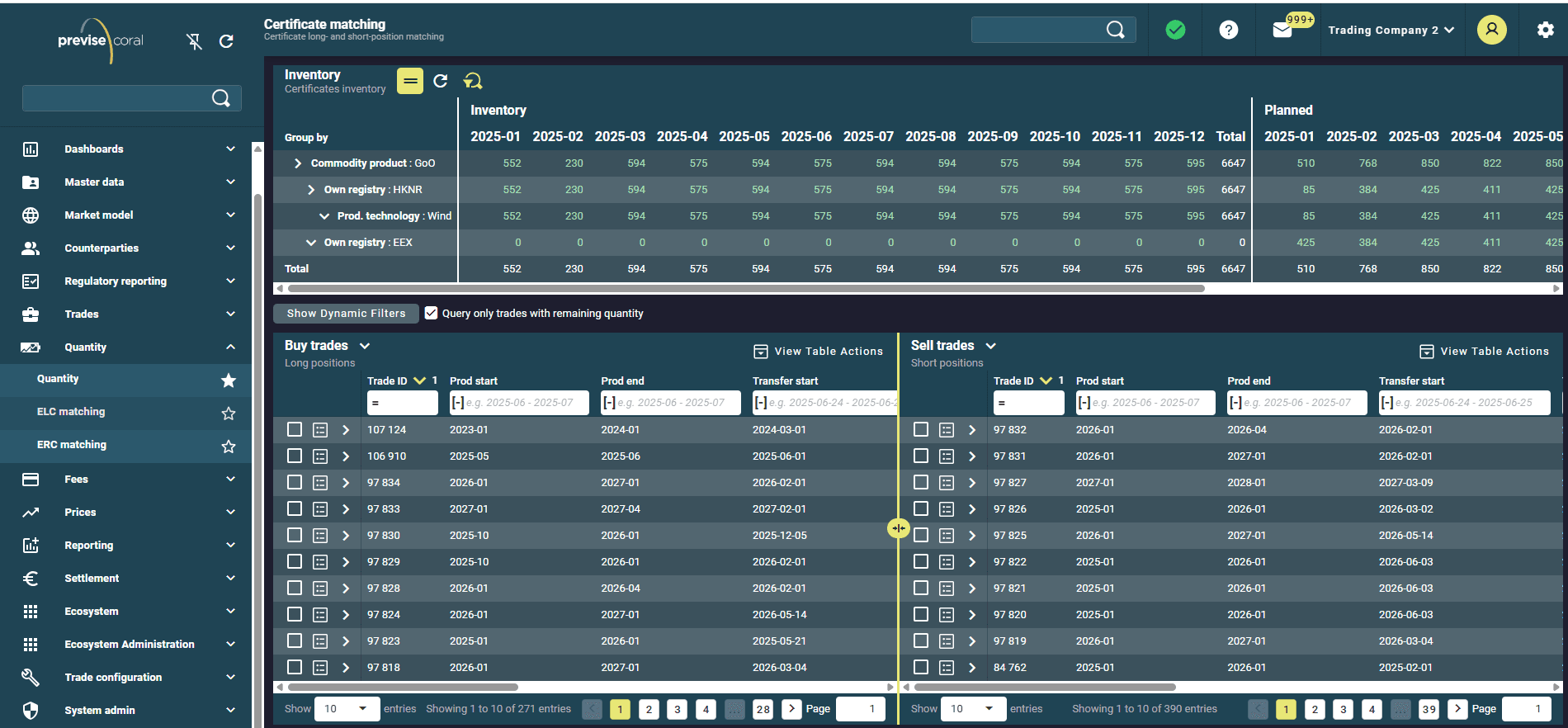

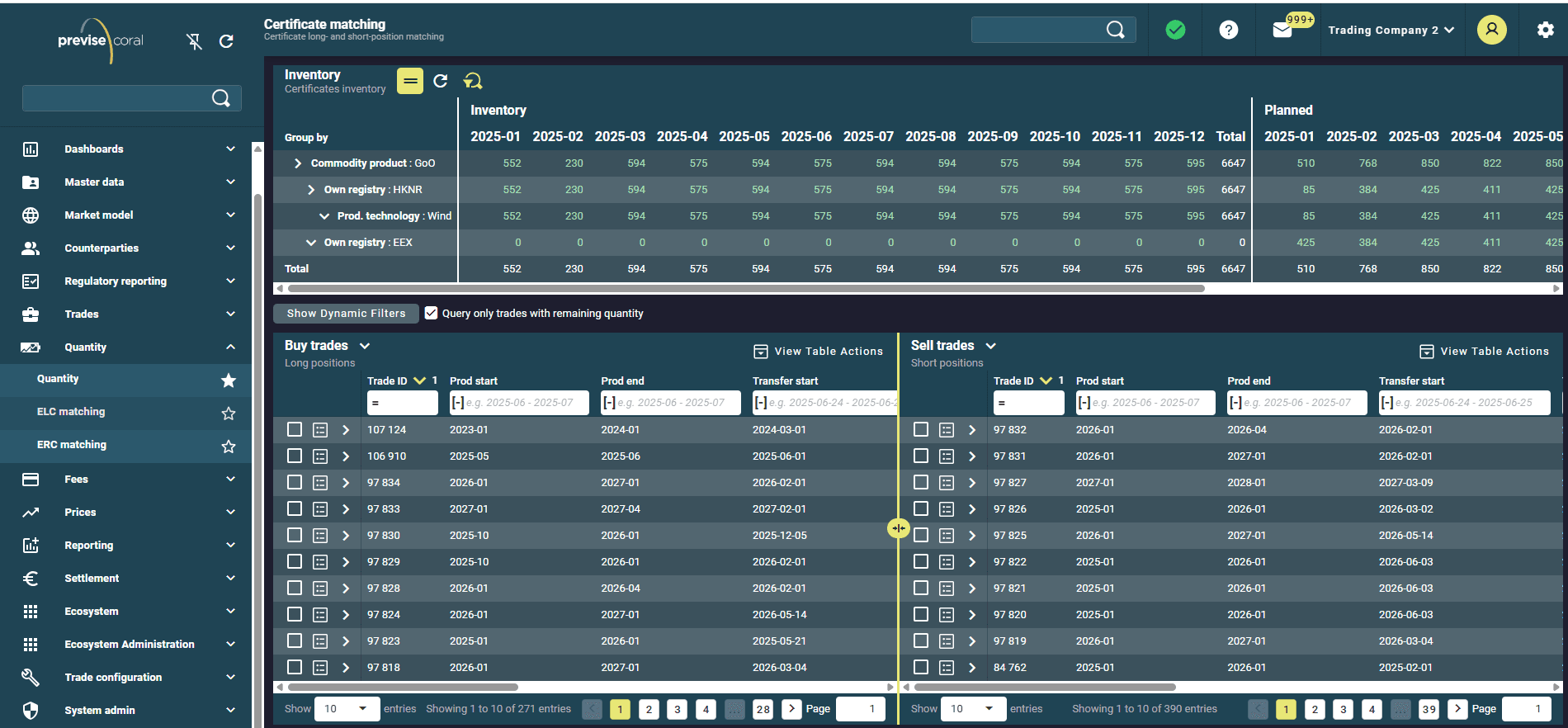

Cross-Commodity Coverage

Power, gas, emissions, and certificates managed in one cohesive platform, with shared workflows and unified data

Integration-First Architecture

Open APIs and the Coral EcoSystem App Framework make it easy to plug into your existing stack - from algo engines to downstream reporting